Lendroid is a trustless, open, peer to peer digital asset lending platform based on the Ethereum blockchain. The Lendroid marketplace enables borrowers to avail instant low-cost digital asset loans and lenders to earn interest on the digital assets they lend. Additionally, Lendroid support token (LST) holders act as guarantors of these loans by locking up their LSTs as secondary collateral. The Lendroid platform is extensible by design and allows the creation of loan markets on any ERC20 token.

Concept

Lendroid brings together lenders, borrowers of digital assets, and guarantors who wish to guarantee these digital asset loans. A ‘borrower’ can collateralize a digital asset to borrow another digital asset from lenders for a short period. At the end of the loan period, the borrower has the option to extend the loan by adjusting the collateral locked or repay the loan along with the accrued interest — or he/she stands to lose their collateral. Guarantors can choose to guarantee loans issued by one or more markets they believe will remain solvent by locking up LSTs which act as secondary collateral for a loan.

The guarantors and lenders are expected to understand the financial risks they expose themselves to by participating in the loan markets. The Lendroid platform does not guarantee profits for lenders or guarantors, and expects them to perform their due diligence before deciding to involve in any market.

What Lendroid Offers

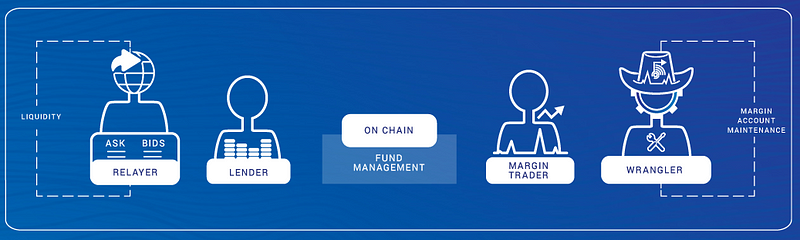

Lendroid seeks to overcome on-chain limitations of latency and impractical gas cost by creating a symbiotic off-chain infrastructure supported by incentivized participants. The native token keeps the network operational, fuels the utility layer of the protocol and offers security to community governance. The ecosystem nurtures a decentralized, global, shared lending pool.

Role of LST holders

The guarantors hold a responsibility to choose and support markets that they believe will remain solvent. The loan remains solvent as long as the value of the primary collateral locked within the loan is greater than the value of the funds that have been lent. If the value of the primary collateral drops below the value of the funds lent, the borrower will no longer feel encouraged to repay the loan. This structure — of splitting the responsibility of discovering solvent markets — reduces the burden on lenders to be diligent about their choice of market.

The guarantors receive 20% of the interest accrued if the loan remains solvent and is repaid properly. If the loan becomes insolvent, the tokens locked in by the guarantors are auctioned off, in addition to the primary collateral, to fulfill obligations to the lender.

Terminology

● Primary collateral — Digital asset locked up by the borrower within a loan contract

● Secondary collateral — Digital asset locked up by the guarantor within a loan contract. The only digital assets that can act as secondary collateral are LSTs.

● Loan expiry — The date and time before which the loan is expected to close.

● Secondary collateral pool — The pool of secondary collateral funds held under each market, committed by one or more guarantors.

● Loan funds — A digital asset that is lent to the borrower.

● Loan funds pool — The pool of loan funds held by each market, committed by one or more lenders.

Architecture

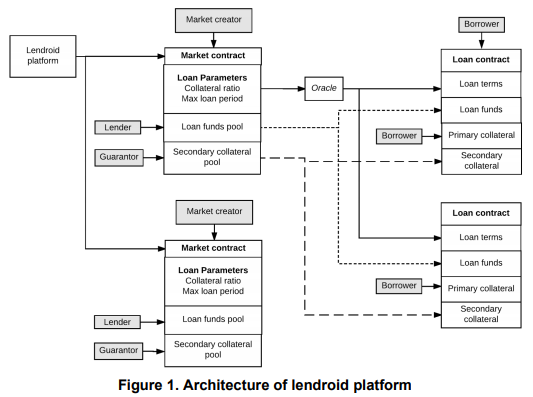

The Lendroid platform consists of two principal components :

● The market contract

● The three party loan contract

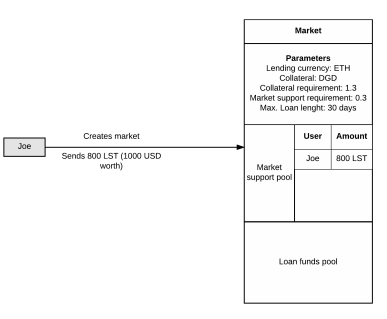

Any person who holds LSTs can create a new loan market. The primary task of market creators is to judge the demand for various types and levels of collateral the borrowers are willing to put up to avail loans. They also have to design markets whose terms reflect the needs.

● The primary collateral ratio cannot be less than 1.2

● The secondary collateral ratio cannot be less than 0.2

● The maximum period cannot be more than 30 days

Lendroid Overview

Lendroid Support Token

- LST is the native token of the Lendroid protocol.

- It is non-rent seeking, meaning it does not collect any fee for itself.

- Protocol users (Lenders, Margin Traders) pay keepers/enablers (Relayers, Wranglers) in LST.

- The fee amounts are negotiated offline.

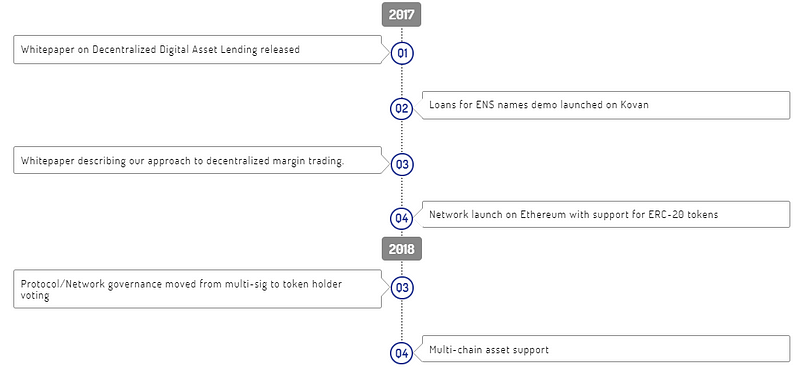

Road Map

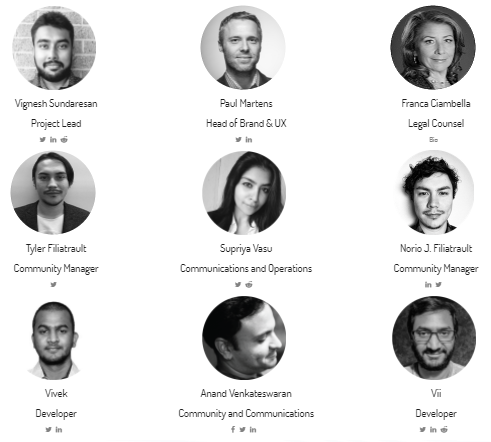

Lendroid Team

Details Information :

Website : https://lendroid.com/

Whitepaper : https://lendroid.com/assets/whitepaper.pdf

Twitter : https://twitter.com/lendroidproject

Telegram : https://t.me/joinchat/GJ8FDBGLY_noGHSBieE8lQ

Profile Bitcointalk :https://bitcointalk.org/index.php?action=profile;u=1109350

Tidak ada komentar:

Posting Komentar