Website :https://getbabb.com/

INTRODUCTION

The financial services industry is — still — ripe for radical disruption. The existing banking system is built on an outdated infrastructure which no longer serves the interest of its retail customers or the microeconomy as a whole. Based on decades-old technology, mainstream banking completely excludes a third of the global population and is very expensive for the other two thirds. Many energetic startup companies with bright ideas and ambitious plans have sought to better serve a segment of the unbanked, the underbanked or the underserved people of this world. For the most part, they’ve attempted this using existing structures, templates, infrastructure and technologies. The progress made so far, by the fintech industry and financial inclusion initiatives, has been promising but limited. BABB’s approach is different. BABB will redesign the economy from the ground up, transforming it from a rigidly hierarchical and exclusionary system into a decentralised and inclusive one. By combining blockchain technology, biometrics and artificial intelligence, we are creating the future of banking, radically different from what the world has seen before.

The World Bank serves the macroeconomy, whereas BABB is the World Bank for the microeconomy. Our ambition is a relatively simple one: everyone in the world should be able to open a UK bank account. The implications of a fully banked global society, however, are huge. This will be a global society of people using smart contracts to make deals, leveraging their social connectivity to make better use of their money. This whitepaper outlines the problems as we see them, the BABB solution and our plan to implement it. We aim to communicate both the full range of our ambition, a broad level of technical detail, and information on how we comply with regulatory requirements.See more here :https://getbabb.com/whitepaper

What is BABB ?

BABB is the decentralised bank for the microeconomy, providing individuals and businesses with a UK bank account, powered by blockchain technology. The account is managed via a smartphone app and provides access to a decentralised payment card. In addition, partnerships with central banks allow for the integration and issuance of other digital currencies around the world, further stimulating local micro-economies and expanding the reach of the BABB solution and its underlying BAX token.

BABB is already an FCA Authorised Payment Institution (API) and will be applying for a Banking licence in early 2018.

The BAX Token

BABB is launching a distributed application platform where FIAT funds are tokenized. These tokenized funds will be used by the BABB APP Bank, partner services, banks worldwide, as well as central banks in developing countries. The BAX token is used under the hood to operate the services of the platform across all the geographies and jurisdictions served by the platform. A summary of the token details can be found on the table in Appendix IV.

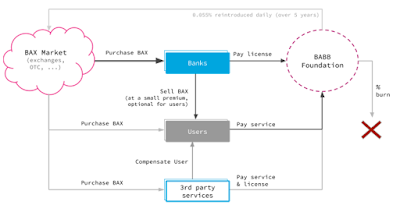

BAX will be implemented on the public Ethereum blockchain as an EIP20/ERC20 token. The Ethereum blockchain is currently the industry standard for issuing custom digital assets and smart contracts, and is compatible with the existing infrastructure of the Ethereum ecosystem, such as development tools, wallets, and exchanges. This active ecosystem and technology make Ethereum a natural fit for BAX. Here’s an overview of the flow of BAX over the whole ecosystem:

Initial Token Sale

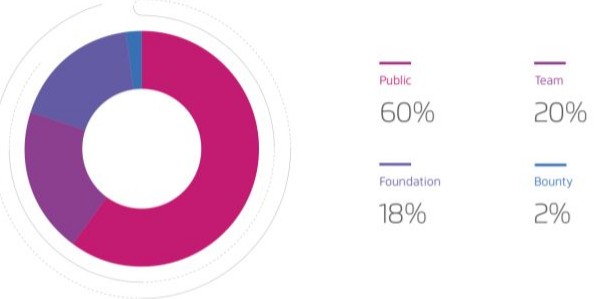

BABB will create 50 billion tokens, allocated as follows:

BABB will be selling 60% of the tokens to the public in our token sale. This will be split over two phases:

○ 40% sold in phase one, with a pre-sale and main sale in early 2018

○ 20% sold in phase two in 2019 at the earliest, once the app is live and BAX in use on the platform

○ Any unsold tokens will be burned.

Team (20%)

The team includes the immediate BABB team, advisers, early contributors and partners. The team tokens are:

○ locked for 1 year

○ 25% are made available at six month intervals

Plartform Reserve (18%)

A portion of the issued BAX tokens will be held by BABB Platform in reserve. This Initial Reserve will enable the platform to maintain liquidity in its BAX operations. See the Reserve Management section below for more details.

Bounty (2%)

BABB is incentivising our community via a BAX bounty campaign. Details of our bounty campaign will be available on our website in due course.

Token Allocation

The BAX token is the lifeblood of the platform. All services, fees and licensing of the BABB platform use BAX under-the-hood.

If a user doesn’t hold any BAX to operate on the platform, they can easily purchase the necessary amount from banks in the BABB platform, and also from other users, online exchanges and other 3rd party services.

For instance, the BABB Bank app allows for BAX to be purchased a single step, without impacting user experience and without the need for the user to take extra actions. The BABB Platform adjusts the amount in BAX required for its services depending on the average token price in open markets, which provides a stable price experience for the end user.

It is only natural and healthy that banks may add a small premium over any BAX they sell, which covers their own costs of service. This paves the way for a fair and healthy banking industry, where people pay only for the services they use and remain in control of their own funds and data.

While we are still deciding on the exact structure of costs, we expect platform fees will be tiny (equivalent to cents of a dollar), for actions such as:

● Open a new BABB account (the bank covers this fee)

● Send/receive a transaction

● Exchange currency

For banks and 3rd Party Services operating on the BABB platform, fees also include :

● Licensing fees (eg, monthly cost paid by a bank to operate on BABB)

● Specialized services such as initiating a fundraising campaign

● Request access to a user’s Identity information (a part of which paid to the user)

Conclusion

BABB’s unique vision for the future of banking is both radical and feasible. BABB will empower each individual and business within the microeconomy, by creating a decentralised and inclusive financial system. BABB intends to usher in a new paradigm of Fair Banking, by embracing emerging technologies and applying a ‘people first’ approach.

The BABB platform has huge potential for growth, through the three main touch points of the BABB app, the Black Card and Social KYC. By maintaining a physical and digital presence and implementing a natural viral growth mechanism, we expect to see exponential uptake throughout our target markets. The BABB proposition is infinitely better than the current offering across many different use cases. The world is ready for BABB, and now we need to make sure BABB is ready for the world.

The token sale will raise the funds necessary to develop and distribute the BABB solution. By purchasing the BAX token, you are taking part in the future we have outlined here. The BAX token is instrumental in BABB’s functionality, and will be integrated into the operations of the platform worldwide. There is enormous untapped potential in the global microeconomy, and BABB (with BAX) has a plan to unlock it.

Join us to help build a World Bank for the microeconomy which is fair, inclusive and connected.

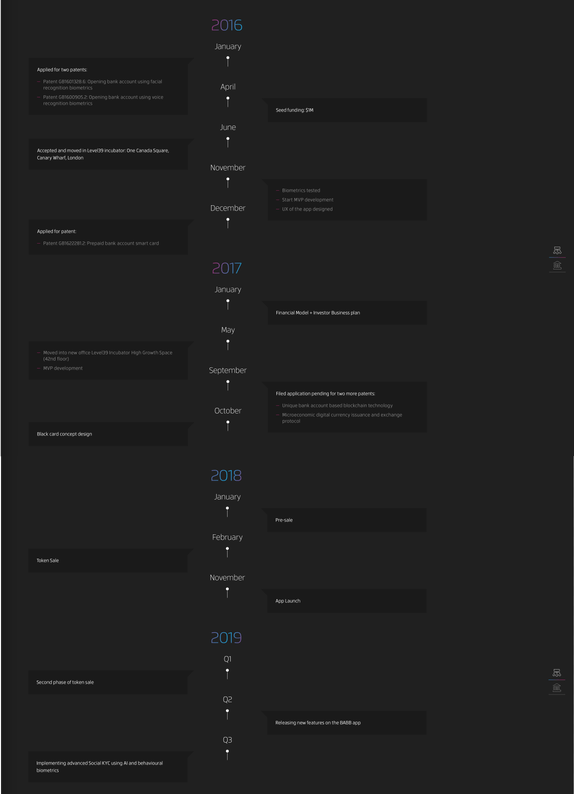

Roadmap

Team

Advisors

Details information :

Website : https://getbabb.com/

Whitepaper : https://getbabb.com/whitepaper

Linkedin : https://www.linkedin.com/company/babb

ANN Thread : https://bitcointalk.org/index.php?topic=2349340.0

Telegram : https://t.me/babb_official

Blog : https://medium.com/@BABB

Facebook : https://web.facebook.com/getbabb/?_rdc=1&_rdr

Twitter : https://twitter.com/getbabb

Username : Ta.Form

Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1109350

ETH : 0xaFA49103b15834D6bCF6ac5a2664b0c85e379b4E

Tidak ada komentar:

Posting Komentar