HOME LOANS

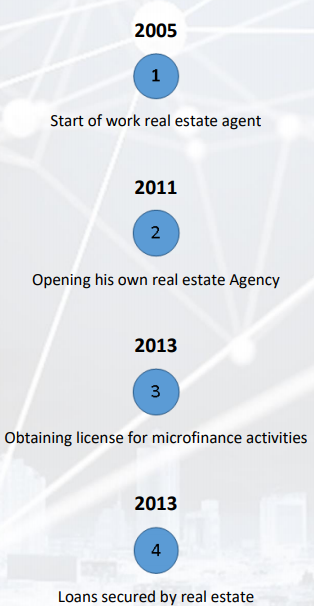

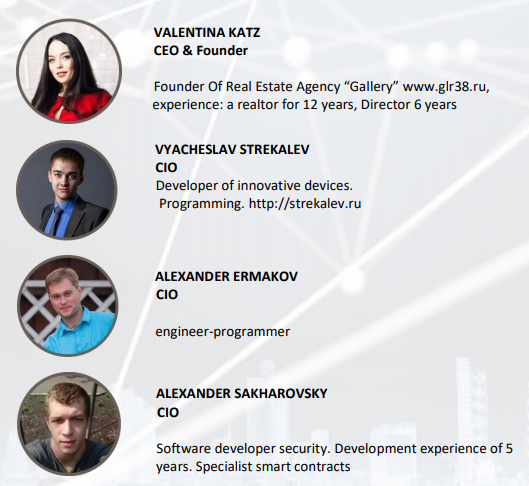

is an experienced team that has been working in the field of real estate for over a decade (www.glr38.ru) and especially with the real estate loans for more than 4 years (license for microfinance activity from the Ministry of Finance of the Russian Federation from 2013) and in IT development for over 5 years (http://strekalev.ru/) decided to create the HOME LOANS platform.

HOME LOANS

is a platform for investment in loans secured by real estate around the world, built on the basis of the Ethereum platform. Token HLCoin platforms will be provided with the real estate objects and will be traded at crypto exchanges. HOME LOANS platform uses complex algorithms to predict creditworthiness of all customers and in just 20 minutes a borrower can get their very first the first loan to purchase real estate in his/her life just from their smartphone.

Loyalty and predictive evaluation system give HOME LOANS various advantages which are listed below:

Noticeably reduced risks when working with new customers;

Credit cancellation without resorting to traditional money;

The costs of rating are much lower than those of traditional banks and other microfinance institutions;

Absolute confidentiality with each customer;

When we enter completely new markets we risk less than our potential competitors;

The opportunity to earn HLcoin for the borrower to repay the loan.

BENEFITS

HOME LOANS for the crypto community: Creation of a crypto-ecosystem

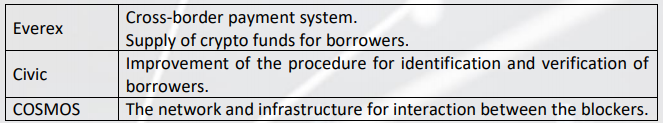

Our goal is to help private investors and business working on the basis of blockchain technology to significantly expand its client base by accessing our real estate lending platform and mobile marketing for business. According to our long-term strategy, HOME LOANS should become part of the cryptosystem. In the future, we are considering integration with the following hightech products.

HOME LOANS for business: attracting new and returning old customers

The business model is extremely simple. Service (mobile application HOME LOANS) leads the client to the partner (counterparty). If the client makes a purchase or uses the service then the seller returns a part of the amount in HLCoin (provided free of charge to the platform) to the customer (borrower) as Cashback, and in traditional money to the account of HOME LOANS. This motivates borrowers to come to our partners and make purchases mobile lid generator. Now business does not need to spend huge money on advertising to attract customers they will come themselves.

HOME LOANS for people: It gives people the opportunity to buy property without resorting to traditional methods like banks. The platform has its own scoring system which analyzes borrower’s credit history and analyzes HLCoin production in the mobile application HOME LOANS. It gives better chances for the borrower whose credit history was damaged due to circumstances beyond his control.

GROWING DEMAND IN THE MARKET

Provides its own loan repayment system without resorting to traditional money.

We forecast strong demand for our international home loan platform HOME LOANS. We will create our platform using open-source-resources where applications with impersonal data will be freely available. Access to personal data only with the consent of the client for the transfer the personal data to the third parties.

HOME LOANS for local partners: global business scaling

We developed business development algorithms in new countries which are based on our work experience and extensive studies of markets and legal segments. We are going to launch an international franchise after launching the platform.

We will share with our franchisees all necessary market research, knowledge of risk management, know-how in the field of loan assessment.

What HOME LOANS will provide for franchisees:

● A reward for each new customer;

● A reward for each new counterparty;

● Deep research of the legal system and market in a particular country;

● A proven business model, financial projections, and cost estimates;

● Expertise and scenarios for customer service and debt collection;

● Various consulting services during business development.

COMPOSITION OF PRIMARY TOKENS OFFER

The first stage of the project is the Pre-ICO HLCoin Token which will start on November 29 and end on December 29, during this period the price is going to be the following:

1 HLCoin = 0.5 $ +50% bonus

The collected money on the Pre-ICO will go to the ICO advertising campaign and creation of a prototype platform and mobile application HOME LOANS.

2. The second stage of the crowdsale project. During crowdsale investors can purchase HLCoin Token at a fixed rate using the US dollar (USD), Bitcoin, Ethereum.

1 HLCoin = 1 $ + bonuses

3. During crowdsale HLCoin will compile a limited number of 150,000,000 tokens and be sold at a fixed price. The total time interval of crowdsale is 30 days.

The primary offer of HOME LOANS tokens and the corresponding process of creating tokens will be based on the use of “smart contracts” launched on the basis of Ethereum.

Name of the tokens: HLC

The total volume of issued tokens: 150,000,000 HLC.

Total amount during the initial sale: 120,000,000 HLC.

Guarantee fund: 30 000 000 HLC

Tokens that will be not sold during the initial offer will be destroyed.

Objectives:

Minimum of 500 000 and maximum of 50 million US dollars.

Original price: the price of the token is fixed at the level of

1 US dollar 1 HLC token.

Token distribution:

Founders 8%

Advisers 4%

Bounty 3%

Investors 85%

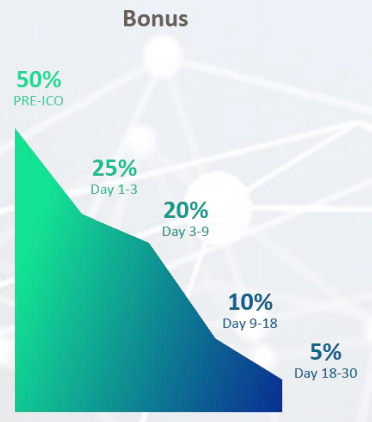

Bonuses to the first investors during the initial offering of the tokens (additional tokens added to the purchase):

PRE-ICO bonus + 50%

1–3 days bonus + 25%

3–9 days bonus + 20%

9–18 days bonus + 10%

18–31 days bonus + 5%

Bonus program (% X of a premium pool):

Facebook campaign — 17%

Twitter campaign — 17%

The Bitcointalk Signatures campaign is 20%

The Bitcointalk Support campaign — 20%

Campaign for publishing information in the media — 11%

Creative support of the project — 10%

YouTube Subscription Company — 5%

ROAD MAP

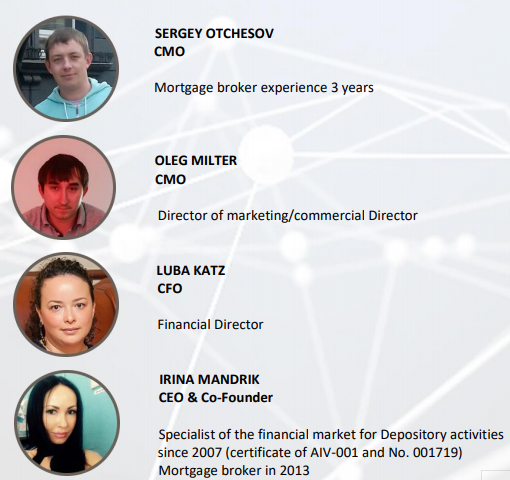

TEAM

We started our activity as a company in 2011. We were fully focused on real estate and real estate lending since 2013 that was aimed at providing optimal solutions for our clients. To improve the professional level in the field of real estate sales and mortgage lending our employees annually undergo advanced training which is confirmed by the relevant certificates.

Every year our organization participates in all forums that take place within the framework of mortgage lending. Our partners are such giants as Sberbank, VTB24, Gazprom Bank, and UralSib.

To program this platform we have attracted programmers and experts on smart contracts. Also, in the process of development and launch we are planning to attract specialists of the blockchain. We will be glad to help other specialists.

CONCLUSION

The counterparty receives customers, the client receive HLCoin tokens to repay the loan, and traditional money which is returned through the loyalty system from our partners and then went to the HOME LOANS account for HLCoin purchase on the exchange & return to the ecosystem of the HOME LOANS system.

Details Information:

Website : http://home-loans.io/

Whitepaper : http://home-loans.io/White_Paper_ENG.pdf

ANN Thread : https://bitcointalk.org/index.php?topic=2479111.0

Telegram : https://t.me/HomeLoansENG

Facebook : https://web.facebook.com/HLCoin/

Twitter : https://twitter.com/HomeLoansCoin/

Profile BItcointalk : https://bitcointalk.org/index.php?action=profile;u=1109350

Tidak ada komentar:

Posting Komentar